Taxes on Retirement Plan Distributions after Age 73

(3 of 7)

Taxes on Retirement Plan Distributions after Age 73

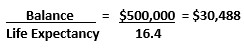

Once you turn 73, you must take withdrawals from your retirement plans. The IRS specifies the minimum amount you must take each year. Failure to make minimum withdrawals can result in severe tax penalties. The IRS requires that you take at least the amount equal to the balance in your retirement account at the end of the prior year divided by the number of years you are expected to live based on actuarial tables approved by the IRS. For example, if you were 73 years old and had $500,000 in your retirement account on December 31 last year, your minimum required distribution this year would be this:

An example

Next year you would repeat the calculation using the new balance and actuarial life expectancy to recalculate the minimum amount. You can obtain life expectancy tables in IRS Publication 590-B, Distributions from Individual Retirement Arrangements (IRAs).

If you are married

If you are married and your spouse is 10 or more years younger than you and is your only beneficiary, you may use the joint life expectancy table for which the required minimum distribution would be lower. In our example, if your spouse was only 52, your joint life expectancy would be 35.2 years and your minimum required distribution would be $14,205. You are not limited to your spouse as joint surviving beneficiary. However, having a non-spousal beneficiary forces you to use the uniform life expectancy table and not the joint life expectancy table.

Lowering your minimum required distribution will help you save taxes on your retirement plan, but you may also be able to take a larger distribution and offset it with deductions.