Investing All at Once, or Lump-Sum Investing

(3 of 5)

Investing All at Once, or Lump-Sum Investing

If market-timing is a losing strategy for many, what about the opposite: putting all the money to work at once? Many financial advisors recommend this approach above the others, because the market goes up more often than it goes down.

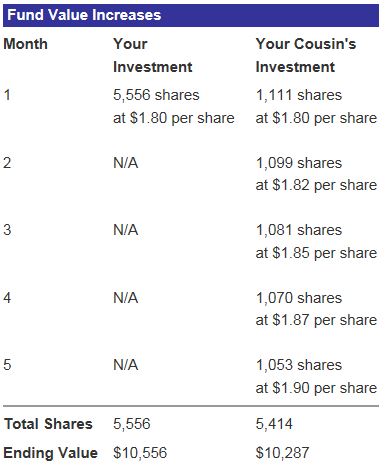

Here's an example. Say you decide to invest an amount of $10,000 all at once in one fund while your cousin, who also happens to have $10,000 to invest, instead places $2,000 per month in the same fund over the next five months. The fund consistently rises in value during that time. The chart below illustrates what would happen to the two investments.

You would end up ahead, because you own more shares at the end of the five-month period. And you own more shares because, due to the consistently rising value of the fund, your cousin couldn't afford to purchase as many shares as you had purchased originally. But what happens if the value of your fund fluctuates dramatically during those five months?

In this case, your cousin ends up in the lead. By investing a fixed dollar amount in the fund every month, your cousin bought more shares when the price was low, fewer shares when the price was high, and ended up with more shares after five months.

To be sure, such drastic fluctuations in NAV are rare. Because the stock market generally goes up more often than it goes down, most investors will receive the best long-term results by lump-sum investing.