Use Price/Book Ratios to Find Value Investments

(5 of 6)

Use Price/Book Ratios to Find Value Investments

Not everyone wants to buy a stock for what it is worth.

Things To Know

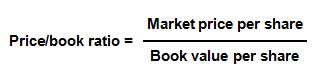

- Price-to-book ratio is a stock’s market price divided by its book value.

- The P/B ratio is one of the cornerstones of value investing.

Value investors are people who look for investments (typically stocks) that are trading on the market for less than their book values, thinking that the market prices will eventually rise to meet or exceed their book values. Stocks of this nature are called value stocks.

Many indicators help investors identify strong companies whose stock is temporarily undervalued. A starting point may be to look at the price-to-book ratio (P/B). The price-to-book ratio is the stock’s market price divided by its book value. What is book value? Book value is the value of the company’s assets—that is, the total equity for common stockholders that can be found on the company’s balance sheet. Equity is the difference between assets and liabilities.

An example

If a company has $200 million in assets and $150 million in liabilities, then its book value is $50 million. If there are 20 million shares outstanding, then each share is $2.50 of book value. If each share is selling on the market at $1.25, then the P/B ratio is 0.5 (1.25 / 2.50).

Here is the formula for it:

Price/book ratio goes by other names, such as "price to equity ratio" and "market to book ratio."

How do investors use price/book ratio?

The P/B ratio is one of the cornerstones of value investing. When a company’s market price is less than its book value (meaning that the P/B ratio is less than 1), it may mean that investors are not currently recognizing its true value. That may change if there is an upcoming alteration in management, a new marketing strategy, or a change in how the company uses its assets. Value investors are always on the lookout for some change that will send the stock price moving upward.

Caveats for using price/book ratio

Some people see a ratio under 1 as evidence of a bad investment, and many value investors proceed with caution when using P/B ratio, because it is not a magic bullet. Here is why:

- A ratio under 1 can mean that the company is not running up to par.

- P/B is only useful for companies with a lot of assets.

- P/B usually ignores intangible assets like brand name and intellectual property.

- P/B can ignore the temporary positives of high debt levels.

- Actions such as paying out dividends, issuing new stock, and repurchasing stock can affect the P/B ratio.

- The value of the company’s assets could be overstated.

- The company could be earning a very poor return on its assets.

- Different accounting styles can affect the ratio differently.

- Inflation affects book value of assets.

- Raising or lowering cash reserves without any change in operations can affect the book value.

Because of these factors, educated investors rarely rely on P/B ratio alone when selecting stocks, or even when selecting value stocks.