Use Financial Statements to Evaluate Investments

(3 of 9)

Use Financial Statements to Evaluate Investments

To find information about a company’s earnings, you should study its income statement and balance sheet. The income statement shows the sources of a company’s income, production costs, and other expenses. The balance sheet shows the company’s overall financial strength and potential for future growth.

The balance sheet

The balance sheet contains important information about a company’s assets and liabilities: what it owns and owes. An examination of the balance sheet can be very revealing to a would-be investor. It is the basic report of a firm’s possessions, debts, and capital. The analysis of a balance sheet can identify potential liquidity problems. These may signify the company’s inability to meet financial obligations. An investor could also spot the degree to which a company is leveraged, or indebted. An overly leveraged company may have difficulties raising future capital. Even more severe, it may be headed toward bankruptcy. These are just a few of the danger signs that can be detected with a careful analysis of the balance sheet.

The formula for a balance sheet is Assets = Liabilities + Shareholders’ Equity.

The income statement

The income statement shows revenues and expenditures for a specific period, usually the fiscal year. Income statements differ by how much information they provide and the style in which they provide the information. The main purpose of the income statement is to report profitability.

Analyzing income statements is an important tool for helping investors appraise their investment options. By analyzing an income statement properly, investors can begin to evaluate the effectiveness of the operations management of the companies in which they are interested in investing. Proper income sheet analysis can help identify good investment opportunities. It can also reduce the risk involved with choosing a poor investment.

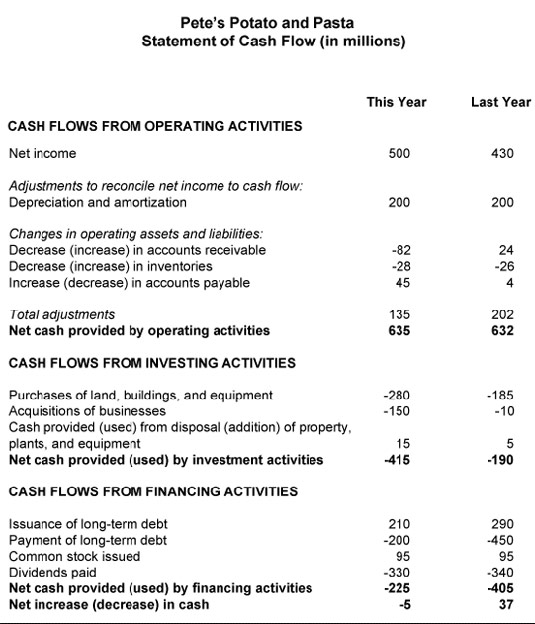

The statement of cash flow

The statement of cash flow is the report that identifies how a company receives and spends its cash. All publicly traded companies are required to publish a statement of cash flow. Firms with poor cash flow may have difficulty making interest payments, loan installments, and dividend payments. The statement of cash flow can also be used to predict future cash flow. This is very important to those investors or creditors who are considering buying stock or lending money to the firm.

The statement of cash flow is separated into three sections: operating activities, investing activities, and financing activities. This breakdown allows investors to see the sources and uses of a company’s cash.

Cash flow is important because it measures the amount of cash a company has available to finance its activities and invest for future growth. Companies also use cash flow to pay dividends and interest to stockholders and bondholders. If a company spends more on investments and financing than it takes in, it will have a negative cash flow and will probably not be able to pay dividends to its investors, even if it makes a profit.

Where to find financial statements

The best place to learn about corporate earnings is the company annual report. The annual report contains audited financial statements. You can obtain an annual report directly from the company’s public relations department or on the Web by searching the Securities and Exchange Commission’s EDGAR database.

If the company is traded publicly, you can find this information (plus more) in its form 10K that it files with the Securities and Exchange Commission; it is also available from EDGAR.